The economics behind holiday spending

As holiday lights go up and shopping lists grow, many families are asking the same question: Why do things still feel so expensive?

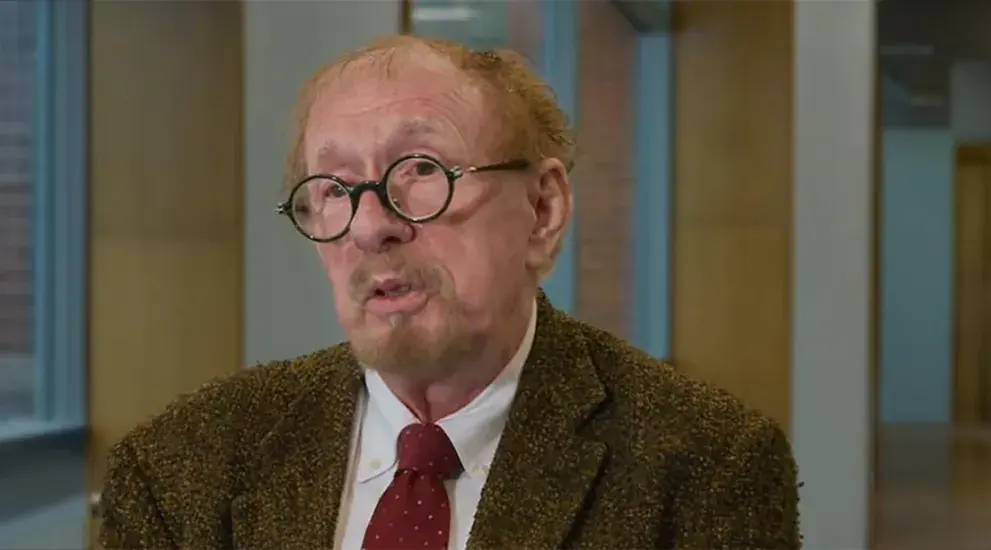

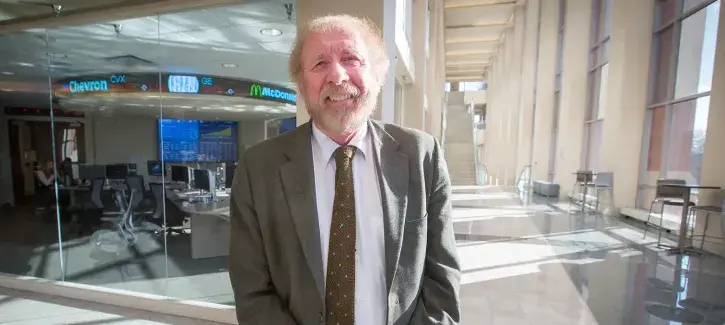

According to Creighton University economist Ernie Goss, PhD, it’s not just about how much prices have risen; it’s also about how quickly they’re still climbing.

“When we say inflation is down, we don’t mean prices are lower,” says Goss, professor of economics and Jack McAllister Chair in Regional Economics. “We mean the rate of growth is down.”

After several years of elevated inflation, he explains, the cost of living has outpaced many wages. So even as the pace of inflation cools, shoppers are still feeling the cumulative impact when they pay for gifts, groceries and travel.

Feeling the pinch

Goss says it’s normal for consumers to feel squeezed when their incomes don’t keep up with the cost of everyday purchases.

“Individuals are seeing that their income has grown less quickly than the prices of the things they buy,” he says. “That’s what we’re seeing this holiday season.”

He expects prices this year to be about 3–4% higher than last year’s holiday shopping period. That may not sound dramatic, he notes, but when layered on top of the inflation seen in 2021 and 2022, the effect is significant, especially for students and young professionals on a tight budget.

His advice? Plan ahead and be intentional.

“You’ve got to plan well and know where to buy and where not to buy. Seek out bargains,” Goss says. “If you plan in advance, you can lower your costs.”

The global side of holiday spending

Another factor in holiday spending this year: the cost of imported goods.

Many items that show up under the tree or on the holiday table rely on global supply chains. Goss says the bottom line is simple: higher trade barriers often mean higher prices or fewer options on store shelves.

“Americans have benefited greatly from access to lower-cost goods from abroad,” he says. “When trade restrictions tighten, some of those products may become more expensive or less available during the holiday buying season.”

At the same time, he notes, global trade remains essential, especially for products that are difficult or costly to produce domestically. The key is balance: leveraging global strengths while staying mindful of impacts on consumers and small businesses.

Consumer debt and a “K-shaped” holiday season

Inflation isn’t the only pressure facing households. Consumer debt is high, and repayment obligations are shaping how many people approach the holidays.

“Debt is going to play a big part in what’s going on,” Goss says. “It’s going to hit certain individuals harder, especially younger people and those with student debt.”

He describes this year’s holiday season as “K-shaped.” Higher-income households, particularly those who own assets like stocks or other investments, may maintain or even increase their holiday spending. Others, especially those facing tighter budgets or carrying significant debt, will likely scale back.

The result: modest overall sales growth, but with significant differences across income levels.

Why shopping local matters

Even in a complex economic environment, Goss sees a clear way consumers can make a meaningful impact: support local businesses when possible. “The number one thing for communities across the nation is to buy locally,” he says. “If it’s price competitive and they provide a good level of service, that’s the best deal. It serves us all.”

Local shops, restaurants and service providers are key to community economies. Money spent close to home supports local jobs, vendors and services in ways big online retailers rarely match.

Practical advice for a thoughtful season

So, what should consumers keep in mind as they navigate this year’s holiday spending? Goss’s recommendation can be summed up in one word: judicious.

“Be careful, be judicious in what you’re buying,” he says. “This is not the time to incur a lot of debt. Make sure what you purchase is something you can truly use...and something you can afford.”

Holiday spending, he adds, offers a real-time snapshot of the U.S. economy. Understanding the forces behind prices — inflation, trade, debt and local economies — can help consumers and small retailers navigate the season with more confidence.

Explore Economics at Creighton

Interested in understanding the forces that shape everyday decisions from holiday spending to national trends? Explore Creighton’s economics program and learn how faculty like Goss connect data with real-world decisions.